If you are considering building an accessory building to rent for short or long-term rental, this post is for you. In Part I (what you are reading now) I’ll describe the Accessory Dwelling Unit (ADU) and the conditions I will use to determine the Return on Investment (ROI) for this type of project. In the following posts I’ll examine the two rental paths described in this post for their payback and financial benefits. The one caveat I’d like to point out now is that a short-term rental does not require as robust of a kitchen space as a long-term rental, and if you wanted to minimize the upfront cost, reducing the kitchen would be the first best choice, but for simplicity sake, I will use the same size, cost, and fees for both.

The ADU: A rentable ADU needs to have a suitable place to live and sleep, a full bathroom, and a full kitchen (sink, stove, and refrigerator, with an optional oven, dishwasher, or microwave). Our modular 16’x24′ ADU Studio is an open plan that groups kitchen, living, and sleeping into a large open plan, with a closet and a bathroom. This is the most efficient layout for an ADU as no space is taken up by walls separating the bedroom from the living area.

Return on Investment or ROI: is a measure of how quickly an investment like an ADU can return to you its cost. “To calculate ROI, the benefit (return) of an investment is divided by the cost of the investment; the result is expressed as a percentage or a ratio.” ROI is measured in time and is an expression of how long it takes to regain the resources you’ve used. This is an important metric, but there are others that we will look at along the way.

In simple terms, how long will it take to pay for your ADU if you rent it out?

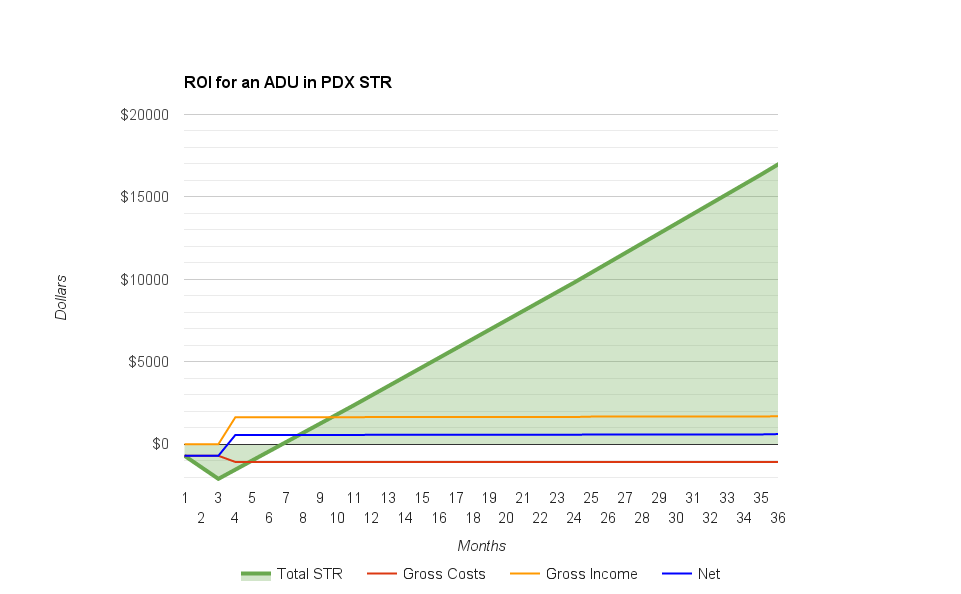

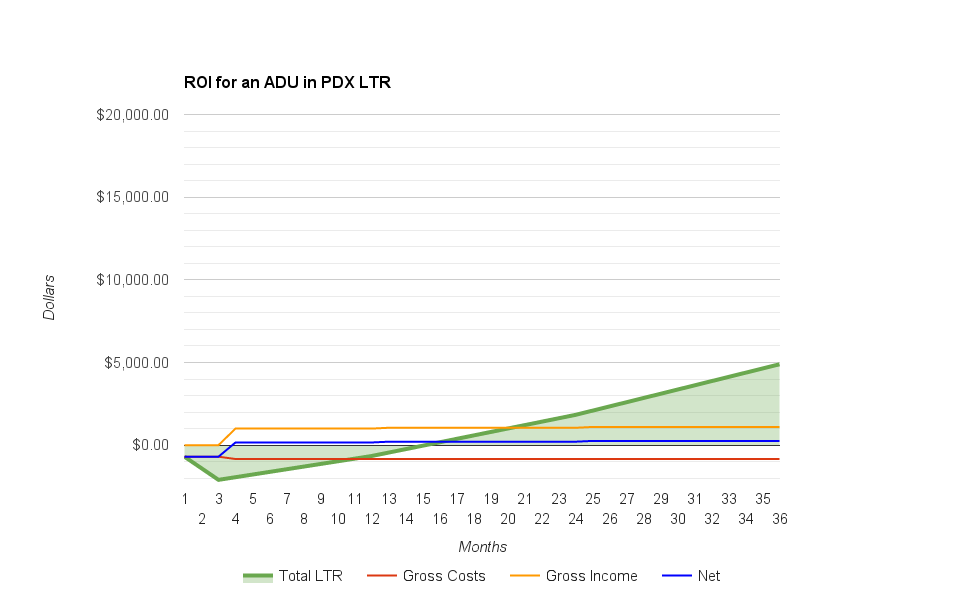

Using a conservative estimate of $95,000 for a finished ADU, including all costs for permitting, landscaping, furnishing, and fit out, we can estimate a monthly payment rate for a typical HELOC of $700/month over 15 years. Since some money is required upfront to build an ADU, you will be paying to service that loan before your ADU is generating income. So the longer your ADU takes to build, the more you pay out of pocket, but worry not, getting out of the hole and being cash positive will only take a few months, and everything after that is positive cash flow. If we estimate 3 months from loan initiation to rental readiness it will only take a month or two of income to reach this positive cash flow with short-term rental, and a bit longer with long-term rental.

With SQFT Studios modular construction techniques, you can be rent ready faster and easier than ever before. That means you will be making money and have a higher net worth in a much shorter time span.

If you pay your monthly installments at the minimum rate, the loan will be paid in full at the end of the 15 year term. Paying off the loan early means having greater equity sooner, but less cash flow on a monthly basis, until the loan is paid. For simplicity sake, we will continue with the assumption of regular minimum payments.

The next blog post will discuss the financial impact of renting your ADU in the short-term, using services like Airbnb. There are several ways to do this, including the DIY method, but Airbnb is the easiest and from our experience the most reliable.

Download our ADU Quickstart Guide and learn about the features and benefits and ADU can provide to your existing property.

Download our ADU Quickstart Guide and learn about the features and benefits and ADU can provide to your existing property.